The company plays a very important role in the development of a country. Any company is oriented towards achieving maximum profit to increase the value of the company. Until now, the company's value is used as a reference for public trust in the performance that has been carried out and achieved by the company since the company was founded [1]. With a high company value, the market will believe in the company's performance and prospects in the future so that it can attract many investors to want to invest [2]. Every investor who invests in it wants a high company value because it can provide prosperity for shareholders [1]. Investors will also be more interested in investing because, with a high company value, the rate of return on investment will also be high. Currently, investment is one of the attractive activities that can benefit economic actors. Investment activities are related to the profits that will be obtained by the company. The value of the company is determined by investment decisions. It is through investment activities that the company can achieve its company goals so investment decisions are a very important part. Some of the factors that affect the value of the company include profitability, debt policy, company growth and company size.

Profitability can measure the company's ability to generate profits and can measure the level of operational efficiency in using the company's assets [2]. A good company's prospects can be described by high net profit so that investors will be more interested in buying shares so that the value of the company will also be higher. In this study, the company's profitability can be measured by the Return On Equity (ROE) ratio because ROE can show the company's ability to manage equity and generate a net profit.

Debt policy is a policy taken by a company to carry out its operations by utilizing debt [3]. Debt policy in this study was measured using DER (debt to equity ratio). DER can measure how far a company finances its operations with debt, the higher the value of the DER ratio, the worse there are symptoms in the company.

Company growth (growth) is described by an increase or decrease in the total assets owned by the company. The company's growth is calculated using the percentage change in assets each year [4]. In this study, Growth is measured by Sales Growth (sales growth). Sales growth can show the extent to which companies can improve their sales capabilities continuously.

Firm size describes the size of a company which can be indicated by total assets, number of sales, average total sales and average total assets Marista [5]. Firm size in this study is measured by total assets that can reflect the size of the company which is seen in the total value of the company's assets.

Several studies have been conducted to look at internal factors that affect the value of the company but the results are still inconsistent. Therefore, researchers are interested in conducting re-research on internal factors that affect the value of companies listed on the Indonesia Stock Exchange as LQ-45 shares for the 2018-2020 period. The internal factors in this study consist of profitability, debt policy, company growth and company size.

Literature Review and Hypothesis

Signaling Theory

Signal theory can provide company signals to users of financial statements, namely investors. The signal is in the form of a statement taken by management regarding the condition of the company's prospects [6]. This signal theory can explain why a company must provide its financial statement data to external parties in this case it is an investor or potential investor. The importance of providing information to external parties is because it is the company's internals who are more aware of the company's condition and prospects. As for external parties, this kind of information is needed to be analyzed before they invest in the company.

Company Values

The value of the company for investors can be reflected in its share price, with a high stock price, the value of the company is also high. If the company can maximize its value of the company, the shareholders in it will also prosper by the main objectives of each company. The prosperity of shareholders and companies is represented by the share price. A high share price indicates that the company's value is in good condition with many investment opportunities for the company's growth in the future.

Profitability

The profitability ratio can measure the level of effectiveness of management in carrying out company operations through sales activities, the use of assets and the use of capital to generate maximum profit for the company [7]. For enterprises, the profit is used for the payment of interest and principal on loans. Meanwhile, for investors or potential investors, profit is one of the determining factors for changes in stock values. But the important thing for the company is how the profit can maximize the prosperity of shareholders with the amount of profit generated by the company [8].

Debt Policy

Debt policy is one of the funding alternatives for companies other than selling shares in the capital market. The debt owed by the company becomes an instrument that is quite sensitive to changes in the value of the company. If the use of debt generates more profit than the costs incurred due to debt, it can increase investor confidence in the company's future capabilities which directly impacts the value of the company. However, an increase in debt can also reduce the value of the company if the benefits obtained from the use of debt are smaller than the costs incurred by debt.

Company Growth (Growth)

The increase or decrease in total assets owned by the company is seen through the growth of its company (growth).

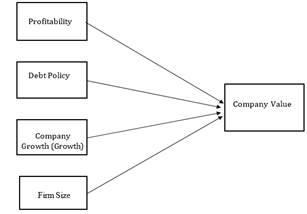

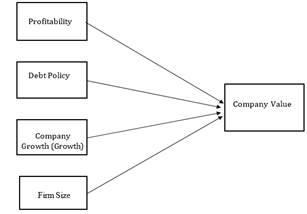

Figure 1: Research Model

The company's growth can be seen from the percentage change in assets every year [4]. The higher the company's growth, the greater the need for funds needed by the company for business expansion activities. According to Kasmir [9], the growth ratio explains the company's ability to maintain its company's ability in the midst of the current global economy. The company's growth ratios are used to see the ability of management to utilize all its resources.

Firm Size

According to Hilmi and Ali [10], the size of a company is a value that indicates the size of a company. The size of the company can be analyzed based on the total value of assets, total sales, market capitalization, number of workers and so on. To analyze the size of the company the researcher uses the total assets as an indicator of the independent variable of the size of the company. Total assets are more suitable for showing the size of the company because the total value of assets is more stable and representative than the value of market capitalization and sales which are generally influenced by supply and demand.

Hypotheses and Research Models

This study aims to see whether there is an influence of independent variables, namely profitability, debt policy, company growth and company value on dependent variables, namely company value. The hypotheses proposed in this study are (Figure 1):

H1: Profitability has a significant effect on the value of the company

H2: Debt policy has a significant effect on the value of the company

H3: The growth of the company has a significant effect on its value of the company

H4: The size of the company has a significant effect on the value of the company