Stewardship Theory

Stewardship theory is a situation where management is not motivated by individual goals but it is more focused on the main goal, namely the interests of the organization [11]. As demands for accountability increase in public sector organizations, it becomes increasingly difficult for principals to carry out their own financial management functions, so that the role of accounting is needed in separating duties between ownership and management functions in order to realize public welfare and accountability for the management of state assets [12].

Quality of Financial Reports

The purpose of financial reports based on PSAK Number 1 is to provide information regarding the financial position, financial performance and cash flow of an entity that is useful for the majority of report users in making economic decisions. Financial reports also show the results of management's accountability for the use of the resources entrusted to them. The qualitative characteristics of financial reports are characteristics that make the information in financial reports useful for users in making decisions of economic value [13].

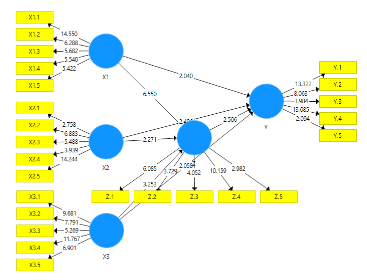

Hypothesis

The Inspectorate is tasked with ensuring that financial reports are free from allegations of material misstatement which will later be examined by the BPK (Financial Audit Agency). Inspectorate officials must have an honest, independent attitude and always be open to all results found and immediately provide recommendations for improvements to improve the quality of Regional Government Financial Reports. In other words, the quality of the audit will have an impact on the quality of the LKPD [14].

H1: The role of the Inspectorate influences the Quality of Village Financial Reports

The use of technology can help prepare quality financial reports, of course with a good system so that it can produce financial reports that have a minimal error rate. Information technology is really needed by organizations or entities to help achieve their goals, but procuring information technology requires a large investment. Information technology investments that have been made by the company must be able to be implemented optimally. Information technology in an organization is not enough to just be managed (managed) by the information technology department, but must be managed (governed) professionally [15].

H2: The use of information technology influences the quality of village financial reports

Professionalism can be seen from a firm attitude to carry out work using the skills one has, in fulfilling social obligations regarding the importance of a role and the benefits of a profession, an attitude in making decisions without being influenced by other parties, being confident in the professional regulations that are carried out, and establishing good relationships with fellow professionals. The quality of financial reports can increase if the professionalism of financial management of each employee also increases [11].

H3: The use of information technology influences the quality of village financial reports

Organizational commitment is built on the basis of workers' trust in the organization's values, workers' willingness to help realize organizational goals and loyalty to remain members of the organization. If workers feel that their souls are tied to existing organizational values, they will feel happy at work, so they will have responsibility and awareness in running the organization [12].

H4: Organizational Commitment moderates the Inspectorate's Role in the Quality of Village Financial Reports

Employees with good commitment will determine how much their performance will be achieved in the organization because of the growing sense of love for their work. The existence of organizational commitment will have a good influence, especially in producing financial reports. In a government context, officials who have high organizational commitment will use the information they have to prepare financial reports [13].

H5: Organizational Commitment moderates the use of information technology on the quality of village financial reports

Organizational commitment is something that is related to the level of involvement of individuals in the organization where they carry out work to remain in the organization. If employees or government officials have a high level of commitment to the organization, the information on financial reporting produced will be of higher quality [14].

H6: Organizational Commitment moderates Professionalism on the Quality of Village Financial Reports

Organizational commitment does not moderate the influence of professionalism on the quality of village financial reports in Situbondo Regency. In other words, the level of organizational commitment does not significantly affect the relationship between professionalism and the quality of financial reporting.

Research Methods

The population in this study were all villages in Situbondo Regency, totaling 132 villages in Situbondo Regency. Researchers used a purposive sampling method. Determining respondents with a total of 264 respondents with 2 respondents in each village in Situbondo Regency, namely the village head and financial report preparation staff in each village in Situbondo Regency. The data analysis method used is Partial Least Square [16].